Frontier Technology Quarterly: Does the sharing economy share or concentrate?

The sharing economy is perhaps the most ubiquitous manifestation of the rapid technological change we have been experiencing. Through smartphones and the internet, sharing economy platforms are facilitating the creation of markets and better use of underutilized assets. The estimate that private vehicles typically go unused for 95 per cent of their lifetime has come to symbolize the significant underutilized resources that are waiting to be shared in society (Knack, 2005). By reducing search and transaction costs, the sharing economy unlocks these resources through cheaper and more accessible options for consumers. Amateur and professional cooks can now offer sporadic dinner experiences in their own kitchens; non-professional drivers can complement their incomes at their convenience. In doing so, sharing economy firms have created convenient solutions to large-scale coordination problems among strangers by providing services in transportation, housing, healthcare, agriculture, and many others in both developed and developing countries.

Despite its current hype, the sharing economy is not entirely new. Some of its features, such as peer-to-peer exchange and the flattening of organization hierarchies, can trace their roots back to the 1990s when the internet began to take off. What makes the current sharing economy different and more consequential is the technology that allows real-time matching of supply and demand at a large scale, enabling the sharing of assets, services and knowledge among strangers.

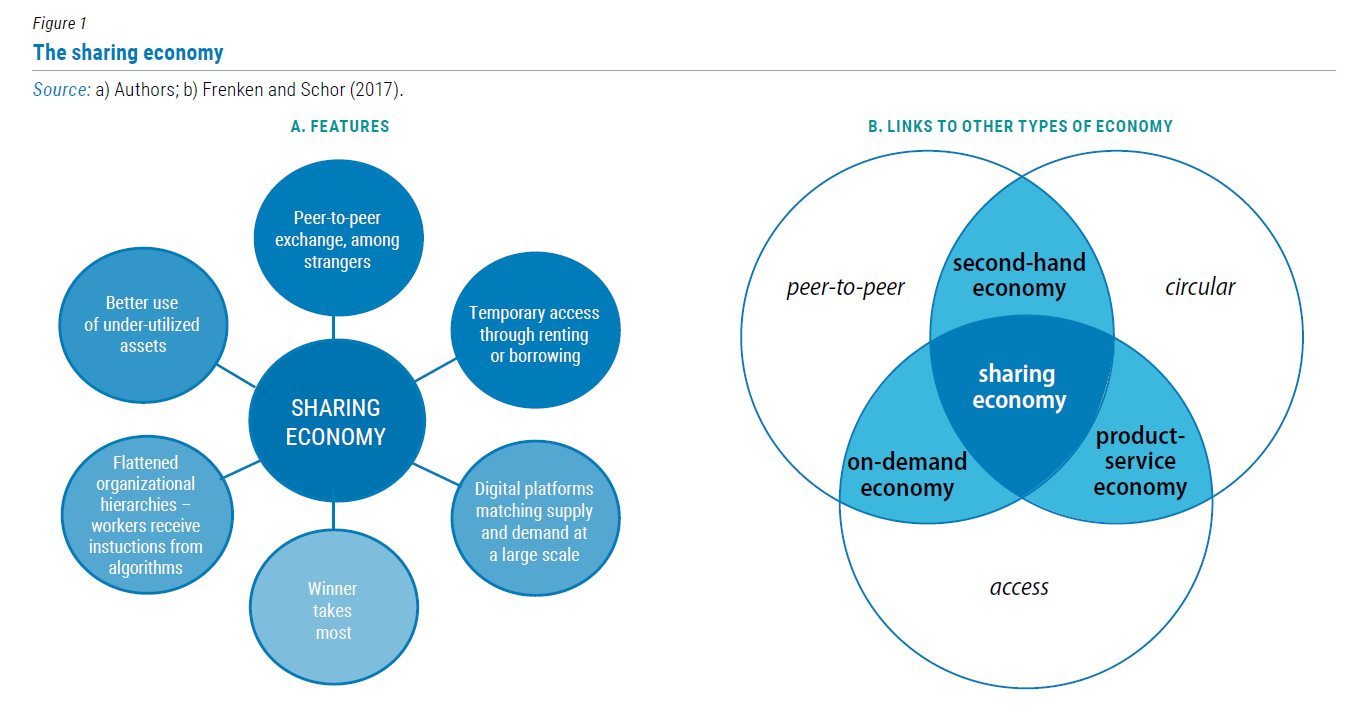

In public discourse, the term sharing economy has often been used interchangeably with many other terms such as platform economy, gig economy, collaborative economy, and on-demand economy. Each of them in fact emphasizes different aspects of an emerging wave of changes to economic organization. In this Frontier Technology Quarterly, we consider the sharing economy as characterized by consumers or firms granting each other temporary access to their underutilized physical assets (see figure 1a). This definition, adopted from Frenken and Schor (2017), can be decomposed into three components: (1) peer-to-peer exchange; (2) temporary access either through borrowing or renting; and (3) better use of underutilized physical assets.

Recognizing the necessary components of the sharing economy helps to distinguish it from other types of economic models (see figure 1b). For example, customers leasing cars from a company, rather than from peers, is an activity in the product-service economy. Digital platforms that match freelancers with consumers—with the former providing the latter. Examples include Hertz and Zipcar. with services, but not sharing or renting physical assets— operate in the on-demand economy. Customers selling or giving away their physical assets to peers, as opposed to granting temporary access to others, fall into the realm of second-hand economy.

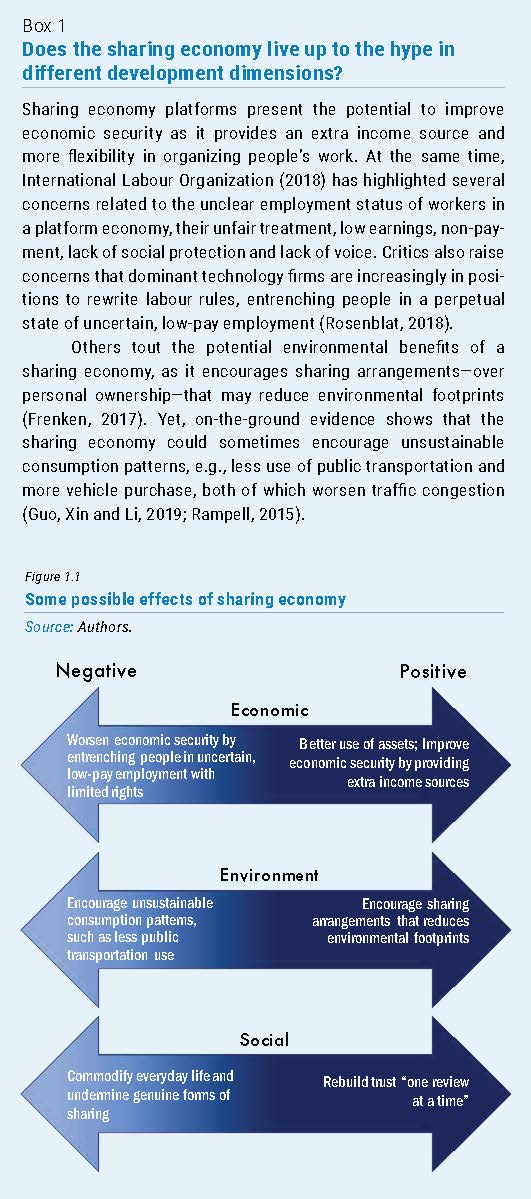

While a decade of rapid expansion of the sharing economy increasingly enable better utilization of assets, it shows little signs of delivering fair and equitable welfare gains for all participants in the sharing economy. Instead it has generated unchecked externalities and unintended consequences. Externalities to industry incumbents, service providers, consumers and cities have been reflected in headlines in the press and academic literature. Among the most unsettling is the observation that, as independent contractors who are managed through algorithms, the providers of the final services do not have access to social security benefits and other labour rights and remain individually liable for accidents, damages and illegal conduct (whereas consumers may assume it is a corporate responsibility). Other externalities include increasing traffic congestion, disregard for city planning and lower access to affordable housing.

Seeking to complement the research and policymaking efforts at the International Labour Organization and many other institutions in addressing such disruptions of the status quo, especially regarding its current and potential implications for the future of work, this Quarterly addresses a concern that is yet to receive adequate attention: the broad effects of the sharing economy on income inequality. The Quarterly also highlights certain differences between developing and developed countries’ contexts that may justify different policy approaches going forward.

How big is the sharing economy and how fast is it growing?

In the three years between 2015 and 2018, the percentage of adults in the United States who have used a ride-sharing service have gone from 15 per cent to 36 per cent (Jiang, 2019). Uber, the leading ride-sharing company, went from providing its first trip in 2010 in San Francisco to a cumulative 5 billion trips worldwide in 2017, which then doubled to 10 billion trips within a year’s time.4 On the other hand, it is estimated that number of guests who used Airbnb, a home and apartment-sharing service, globally rose from a meagre 20,000 in 2009 to 100 million in 2017. As of the first quarter of 2019, Airbnb has more rooms listed globally than some of the world’s largest hotels—Marriott, Hilton, Wyndham and InterContinental Hotels Group—combined (Keyes, 2019).

It is difficult to accurately estimate the economic value of the sharing economy, as gains generated are not always reported. Preliminary, and limited, estimates suggest that around half of total GDP in the European Union was composed of sectors which were significantly affected by sharing in 2015. Yet, the total economic impact of the sharing economy accounted for less than 1 per cent of GDP (Feubli and Horlacher, 2015). The scenario would likely be very different going forward. In 2013, five sharing and platform economy sectors—peer-to-peer accommodation, car sharing, online staffing, music and video streaming, and peer-to-peer finance—generated around $15 billion in sales revenue, which was about one-fifteenth of the revenue generated by five comparable traditional sectors. In 2025, the revenue from the former group is projected to grow 22-fold to $335 billion, matching that of the traditional sectors (PriceWaterhouseCoopers, 2015).

Does the sharing economy actually share or does it concentrate societal resources?

The sharing economy is celebrated by its biggest advocates as a model where commerce and community harmoniously meld so the pursuit of one does not come at the expense of the other. In this view, the sharing economy is seen as a vehicle that leads us to a world where not only societal resources are more fully utilized, but also the efficiency gains resulting from better asset utilization are fairly shared. Evidence of lower cost and higher variety of options on sharing economy platforms suggest the fast-growing sharing economy has enhanced asset utilization, but it remains far from clear whether associated welfare gains are shared equitably. Rising protests in many countries against sharing economy firms reveal a somehow dystopian possibility. As will be discussed in this section, there are several unequalizing forces that are at play in the sharing economy that, without counteracting actions, could further worsen inequality (see figure 2).

Sharing economy high-tech “disrupters”, in possession of extensive customer data and proprietary and self-enhancing algorithms that instantly process such data, have been able to capture rents by intermediating interactions within the sharing economy in ways that the world has never seen. These firms are altering people’s consumption patterns on a large scale, nudging environmental, social and economic actions of millions who provide and use their final services. The likely continued expansion of the sharing economy begs the question of how the increasing gains would be distributed among suppliers, consumers and the intermediaries.

Network effects: concentrating market share

The leading sharing economy firms typically dominate their respective industries. Despite the generally low switching costs across platforms, the sharing economy presents a “winner-takes-most” type market, with typically one or two firms dominating the market share. Network effect across the supply and demand sides of the platform— i.e., the value of service for one side increases with the size of another side—contributes to such dominance. So does the high up-front sunk costs associated with development of technologies for storing and processing data, which create high barriers to entry. The leading firms also enjoy, to some extent, the “first-mover” advantage, as the massive trove of customer data that they accumulate could serve as another barrier to entry for competitors from entering the market or prevent them from competing effectively once they enter. Even if start-ups enter the market, they soon face competitive pressure and may eventually be acquired by dominant platforms.

The tremendous commercial potential of the sharing economy and the dominance of the leading firms in it have led their market valuation to skyrocket, and given the small number of staff relative to traditional firms, the financial return to their operations is concentrated in the hands of fewer people. These leading firms also possess a tremendous amount of detailed personal data. Such high data concentration in a few firms has negative distributional consequences as it means this small number of firms are at the front and center when it comes to extracting the immense economic value that these data hold.

Information asymmetry: concentrating economic gains toward the platforms

As an intermediary, sharing economy firms extract a significant portion of the producer surplus created by platform transactions, i.e., the difference between the price charged to a customer and the lowest pay-out to a service provider that he or she is willing to accept. Information asymmetry and the complexity of the platform algorithms allow firms to press their advantages over service providers and maximize extraction of value created (rents). The dominance of these firms in their respective markets also further tilt the balance of power between firms and workers in favour of the former, especially should a monopsony-like situation arise in the future.

Unequal playing field: structural inequalities and discrimination

While seeming accessible to all, the sharing economy does not necessarily present a level playing field. Based on interviews with three for-profit US-based platforms, a study shows that platforms increase income inequality among the bottom 80 per cent of the income distribution, as most workers or “entrepreneurial consumers” have well-paying full-time jobs, but use the platforms to augment their income (Schor, 2017). These highly-educated workers could also crowd out the less-educated workers who have traditionally occupied such sectors (ibid.). Additionally, as sharing economies enable asset sharing, they also tend to favor existing asset owners, while increasing vulnerability of those who might over-leverage to buy assets to participate in the platforms.

Another paradox is that the sharing economy, brandishing an ethos of sharing and egalitarianism, may in fact amplify the importance of identity and allow for more rampant discriminatory behaviours and practices that are somewhat contained in the public workplace. Schoenbaum (2017) argues that since the sharing economy relies on intimacy as a risk-mitigating mechanism to build social trust between strangers, the significance of identity traits of buyers and sellers along the axes of class, gender, race, sexual orientation, disability, and others, becomes magnified. For example, it has been found that renters with African-American sounding names were 16 per cent less likely to be accepted by hosts on Airbnb (Edelman, Luca and Svirsky, 2017).

Is the sharing economy different in developing countries?

The emerging, albeit small efforts that focus on the sharing economy in the developing world have found evidence suggesting that the sharing economy also offers significant potential, as it can help to overcome certain development barriers that are more pronounced in those countries, such as labour market informality, low female labour force participation and scarce assets. It might even present a possibility that these equalizing forces—more salient in developing countries—can lead to an overall improvement in economic equality, counteracting the unequalizing forces discussed in the previous section.

Yet, important obstacles persist. These include limited access to the internet, smartphones and mobile payment systems; the lack of financial resources that enable people to acquire necessary assets, such as cars and machineries; and, inadequate complementary institutions and infrastructures that allow people to positively participate in the sharing economy.

Access to productive assets

In developing countries, where the agricultural sector employed around 70 per cent of workers in as recent as 2017 (Kuhn, Milasi and Yoon, 2018), the sharing economy creates growth opportunities by providing access to modern farming equipment. An example is Hellotractor, which enables African farmers who own tractors to rent them to others that do not have the equipment. Other platforms have also been created to fill gaps in services. For instance, in Kenya, Flare, an ambulance-hailing service, has helped create faster emergency responses for people who live far from hospitals. This service is particularly important when centralized ambulance dispatch services do not exist, as in many developing countries.

A remedy for informality

While the sharing economy has been criticized for its role in deregulation in developed countries, it has shown to have produced some incremental improvements in labour conditions, at least initially, in developing countries where the informal economy is typically large. Sharing economy platforms are reported to help ensure immediate payment for service providers and provide some protection for vulnerable workers from unfair treatments by allowing a system of rating clients (Surie, 2017). Platform technologies also incentivize employees to open bank accounts, which help improve financial inclusion, incorporate informal workers into employment-linked social protection schemes and facilitate tax collection (Hunt and Samman, 2019).

An instrument for gender equality in low-income countries

Certain benefits of the sharing economy could be particularly pronounced for women in low-income countries, where only 17.2 per cent of women work in the formal economy (ibid.). Some emerging evidence has shown that in developing countries women enjoy a larger income boost from providing sharing economy services. For instance, Airbnb (2017) reported that globally women earn more discretionary income through the platform than men and this extra income is especially impactful in developing countries. A comparative study on six countries has shown that ride hailing generates a 13 per cent income boost for female drivers, compared to 7 per cent for male drivers, and the effect for women is higher for countries with a lower female labour force participation rate (International Finance Corporation and Uber Technologies, Inc., 2018). This can be explained by the lower likelihood that women drivers were working full-time before signing up for ride-hailing work, as women continue to bear the brunt of childcare and household duties and face more stringent cultural norms concerning work, independence and mobility.

Sharing instead of buying

Low asset ownership rates in developing countries present another development potential of the sharing economy. For instance, lower initial car ownership provides the possibility that more people may opt for car sharing directly, without ever going through the car ownership stage. But this will not happen without proper incentives, as the case of increasing car ownership in China resulting from the establishment of Chinese ride-sharing service Didi Chuxing has shown (Guo, Xin and Li, 2019).

Self-regulation or regulatory oversight?

Regulation of the sharing economy must take into account information asymmetry, economic externalities, and network effects. Without effective regulations, dominant sharing economy firms increasingly act as de facto self-regulators—ones without public accountability—in their sectors, favouring private over public interests and efficiency over equality. Given their sheer size and sprawling reach, these platforms may also encourage other firms, including those beyond the sharing economy, to emulate their practices. This calls for vigilant regulatory efforts to enhance market competition, access to data, pricing and algorithm transparency, and tax cooperation, among others—all of which have consequences for how welfare gains from the sharing economy are being distributed among firms, workers and consumers.

Addressing information asymmetry remains a central regulatory challenge. Complex algorithms used by the sharing economy platforms create significant opacity around their operations and pricing advantages. A push to get firms to release data could be a first step to penetrate that inscrutability. A more forward-looking policy move would be to make algorithms more transparent and accountable for their effects, especially the effects on how the gains are distributed among various actors. It would require tackling daunting challenges such as making complex algorithms— sometimes developed by machine learning systems that are not instructed by any human—comprehensible to the public. It also requires multiple government agencies to collaborate in reviewing and supervising algorithms, as sharing economy companies operate at the interface of a range of existing laws, including labour, privacy, data protection, consumer protection and market competition.

Market concentration has implications for the power balance between firms on one hand, and consumers and workers on the other. Sharing economy firms would be more able to abuse their power should a monopoly or a monopsony-like situation arise. In addressing competition issues, policymakers must consider the interaction between competition, innovation and consumer protection. For instance, allowing unrestrained collection of personal data by firms creates data privacy and antitrust concerns, but overly restrictive data collection requirements could hurt innovation efforts that rely on analyzing a massive amount of data (Cheng, 2019). At the minimum, regulators in different policy spheres should coordinate and consult with each other while pushing for regulatory changes in their respective fields when responding to the rise of the sharing economy.

Tax collection through the platforms can represent a considerable gain for governments, especially in developing countries, and an important instrument for redistribution. A crucial step will be to devise strategies to bring sharing economy activities out of the sphere of illegality in which they operate in many countries. At the international level, sharing economy platforms also benefit from the loopholes that a taxation framework designed for brick and mortar businesses represent. Important initiatives are moving forward in this regard (United Nations, 2019), promising to generate revenues for developed and developing countries alike.

Follow Us