UN/DESA Policy Brief #52: The Marshall Plan, IMF and First UN Development Decade in the Golden Age of Capitalism: lessons for our time

The World Economic and Social Survey 2017 reviews the discussions on development presented in WESS over the past seventy years. The objective is to bring the insights and the historical experience of 70 years of development policy analysis to inform implementation of the 2030 Agenda for Sustainable Development. This note is a brief review of lessons from the three major development events during the Golden Age of Capitalism that have left a long-lasting influence on development policy making.

The Golden Age of Capitalism spanned from the end of the Second World War in 1945 to the early 1970s, when the Bretton Woods monetary system collapsed. It was a period of economic prosperity with the achievement of high and sustained levels of economic and productivity growth. During the Golden Age, the themes taken up by World Economic and Social Survey, henceforth referred to as the Survey, varied from year to year, in response to pressing development concerns.

Three events from the Golden Age that left significant lessons relevant for the implementation of the Sustainable Development Goals include: the contributions of the Marshall Plan, the experience leading to the achievement of current account convertibility under the IMF Articles of Agreement and the declaration of the First UN Development Decade.

The Marshall Plan marked the very beginning of successful international cooperation in the post-war period. The current account convertibility was achieved in 1958 under a fully negotiated multilateral payments system with flexible application of international norms. The First Development Decade is the origin of all other development decades and strategies under the auspices of the United Nations, including the Millennium Development Goals and Sustainable Development Goals.

The Marshall Plan: the power of international solidarity

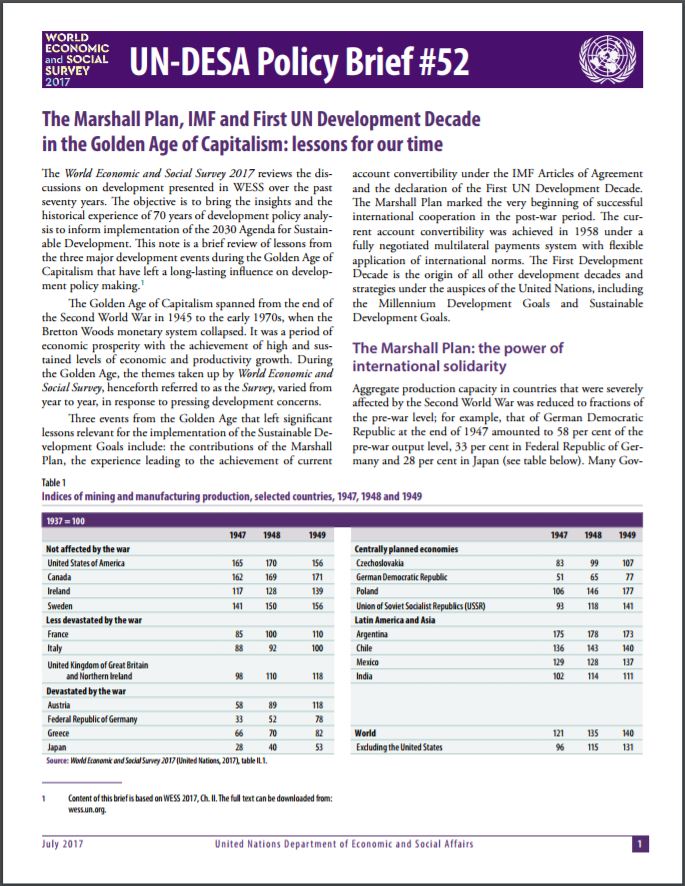

Aggregate production capacity in countries that were severely affected by the Second World War was reduced to fractions of the pre-war level; for example, that of German Democratic Republic at the end of 1947 amounted to 58 per cent of the pre-war output level, 33 per cent in Federal Republic of Germany and 28 per cent in Japan (see table below). Many governments in war-affected countries ran budget deficits in an effort to rebuild housing, industry and infrastructure. Thanks to their efforts, many countries surpassed the pre-war level of productive capacity by 1949. Despite these successes, the countries faced severe balance-of-payments (BOPs) difficulties with large deficits due to reduced domestic production and strong demand for imported goods. In the absence of a functioning multilateral payments system international payments had to be done bilaterally, which constrained international trade.

The political will generated by the end of WW II helped address strong need for resolving the BOPs complications faced by Western European countries. This resolve led to the implementation of the so-called Marshall Plan (officially called the European Recovery Program) and the creation of the Bretton Woods monetary system, the two epoch-making events in the Golden Age of Capitalism.

The Marshall Plan was a United States initiative designed to assist countries in Western Europe in their efforts at restoring productive capacity and resolving widespread poverty and hunger. 2 It also aimed at supporting the creation of a multilateral system of international payments to eliminate currency exchange controls and to facilitate cross-border trade among Western European countries. The Plan amounted to about 1 per cent of the gross national product of the United States in each year from 1948 to 1952. The aid significantly eased the demand for dollars by recipient countries, as it accounted for more than 40 per cent of the United States exports to Western Europe and Japan in 1948.

International payments system: flexibility in the application of the international commitments

With funds under the Marshall Plan, the European Payments Union was created in 1950 to abolish a myriad of bilateral payments agreements inherited from the 1930s, and to settle intra-European balances in a multilateral system. The Union marked a major step towards a multilateral system of international payments. Moreover, it is often considered as the starting point for the rapid growth of international trade over the next 70 years.

The creation of a multilateral payments system began during the Second World War at the United Nations Monetary and Financial Conference, held in Bretton Woods,

New Hampshire, in July 1944. Articles of Agreement for a proposed International Monetary Fund (IMF) were drafted, based on the common views shared by the negotiators on the importance of full employment and a liberal multilateral payments system. The Fund became a formal entity in 1945 with 29 member countries, having as its initial goal the reconstruction of the international payments system. The intention was to mandate each country to adopt a monetary policy that sustained its fixed exchange rate to gold (with a ± 1 per cent margin). The role of IMF was to support temporary payment imbalances.

As a result of the chronic dollar shortage, however, most countries were unable to comply with their obligation under the IMF Articles to dispense with foreign exchange restrictions and current account convertibility, when the agreed transition period was over at the beginning of 1952.

Over the course of the 1950s, world trade and international payments became more stable as a result of an increase in the production capacities of countries, improved intraEuropean trade and the accumulation of foreign reserves in most countries. With these improved conditions, the United States recession in 1957-1958 did not lead to dollar shortages, thereby allowing the liberalization and payments to continue.

By the late 1950s, the Bretton Woods monetary system appeared to be on solid ground. In 1958, the foreign exchange controls had been removed and current account convertibility had been adopted by most countries in Western Europe.

The flexibility shown by IMF, through which countries were granted sufficient time to comply with their obligations was a determinant of the success in creating the multilateral payments system envisaged in the Bretton Woods conference in 1944.

The First UN Development Decade: the Quest for Development

Development challenges faced by developing countries were the focus of UN deliberations and the Survey throughout the 1950s and 1960s. The importance of these issues was in tandem with the recovery of the global economy from the war devastation, the break-up of the traditional trade relationship between industrialized and developing countries after the Second World War, and the birth of many nations as a result of decolonization.

Already in the late 1950s, the Survey argued that effective development requires fundamental changes in the institutional and social structure of countries, reflecting recognition of the need for political will and policy coherence both at the national and international levels.

A strong political will was expressed in the General Assembly (GA) resolution 1522 (XV) in 1960, when setting a target of 1 per cent of the combined national incomes of developed countries to be transferred to developing countries to support their development efforts. Furthermore, in December 1961, the GA decided to designate the 1960s (1961-1970) as the Decade of Development, in which one of the targets was to achieve a minimum annual rate of growth of aggregate national incomes of 5 per cent for developing countries. The international community shared the view that the socio-economic development of less developed countries “is not only of primary importance to those countries but is also basic to the attainment of international peace and security and to a faster and mutually beneficial increase in world prosperity.”

Reflection

The successful conclusions of the three initiatives—the Marshall Plan, the creation of the IMF and the adoption of the First Decade of Development—rested on the common vision of shared development among world leaders at the time. The large-scale impact exerted by the Marshall Plan in Western Europe attests to the importance of international solidarity for the recovery of production capacity and stable economic growth. The implementation of the Marshall Plan remains a significant example of development cooperation, which can serve as a guide for the successful implementation of the Sustainable Development Goals.

The flexibility that European countries were afforded in meeting their IMF-related obligations enabled the successful creation of the multilateral international payments system. Six years after the initial commitment in 1952, most Western Europe countries had eliminated foreign exchange restrictions and established current account convertibility. The flexibility demonstrated by IMF provides a valuable policy lesson that is highly relevant today.

The declaration of the First Development Decades led to subsequent UN Development Decades (1971-1980, 19811990 and 1991-2000) and to the Millennium Development Goals (2000-2015) and the Sustainable Development Goals (SDGs) (2015-2030). The formulation of the SDGs are the most comprehensive and ambitious set of development goals ever to have been adopted, and attests to the inspirational impact of the traditions in development thinking and practices from the Golden Age.

Prepared by Diana Alarcón and Hiroshi Kawamura UNDESA, DPAD. This document was prepared in the context of the World Economic and Social Survey 2017. The opinions expressed here do not necessarily represent the views of the United Nations.

Follow Us