World Economic Situation and Prospects: July 2024 Briefing, No. 182

Prices on a warming planet: The Inflationary effects of Climate Change

Prices on a warming planet: The Inflationary effects of Climate Change

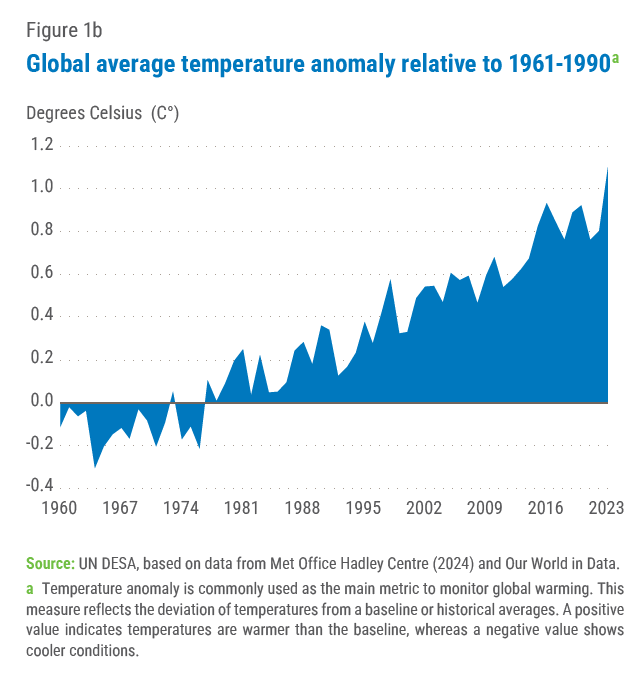

Climate change is no longer a distant threat. Its adverse impacts on both human societies and natural ecosystems are already unfolding across the world. The year 2023 was the warmest year on record by a clear margin, and records were broken for ocean heat, sea level rise and glacier retreat. The multifaceted nature of these impacts is evident through droughts, forest fires, excessive precipitation, floods, heatwaves, hurricanes, intense frost periods, and weather that defies seasonal patterns (figure 1a). Global surface temperature has increased faster in recent decades, reaching 1.1 °C above 1961-1990 average in 2023 (figure 1b). There is now a high degree of confidence that human-caused climate change, by affecting many weather and climate extremes in every region, has led to widespread adverse impacts, with extensive loss and damage.

The increased frequency of such events has become a source of supply-side shocks, emerging as a key risk to price stability around the world. While isolated supply-driven price shocks from extreme weather events tend to be localized to specific goods or commodities, when multiple severe weather events converge or an exceptionally intense one occurs, especially at an important node in a supply chain network, the resulting supply shock can be substantial enough to push inflation up.

The increased frequency of such events has become a source of supply-side shocks, emerging as a key risk to price stability around the world. While isolated supply-driven price shocks from extreme weather events tend to be localized to specific goods or commodities, when multiple severe weather events converge or an exceptionally intense one occurs, especially at an important node in a supply chain network, the resulting supply shock can be substantial enough to push inflation up.

The past three years have served as a stark reminder of how rapidly compounding supply shocks can reverberate through the global economy. The convergence of Covid-19 pandemic-induced disruptions, geopolitical conflicts, and the intensifying impacts of climate change coupled with demand-side pressures drove inflation rates worldwide during 2022-2023 to record high levels not seen in decades (figure 2). With several factors concurrently affecting inflation, it is difficult isolate the precise contribution of climate change.

Supply bottlenecks, along with demand side factors such as tight labour markets and growing wages contributed to upward pressure on prices in developed countries, where core inflation proved stickier than expected. Many developing economies experienced elevated food price inflation during 2022-2023 due to the pass-through from international to local prices, weak local currencies, and climate-related shocks. Additionally, the return of El Niño impacted climate patterns, affecting key staple crops. Since early 2023, inflation started to decelerate in many countries on the back of the aggressive monetary tightening cycle and the easing of supply bottlenecks, although the decline set in later in developing economies than in developed ones.

Concerns remain that inflation could resurge, as international food and energy prices have edged up in recent months, amid geopolitical tensions in the Red Sea, transit challenges in the Panama Canal. Moreover, climate-related shocks, including heatwaves, droughts, and floods, threaten to impact crops, adding pressure on food prices.

Transmission channels

There are multiple channels through which climate change can affect inflation, with shocks to agricultural output being perhaps the most evident. Climate change and extreme weather events exacerbate the fragility of food production systems and impact agricultural productivity. Empirical evidence indicates that extreme temperatures, changing weather patterns and advancing desertification have caused a significant decline in agricultural yields. Flooding, escalating temperatures and prolonged dry spells also pose a significant risk to agricultural productivity.

Staple crops like corn, soybeans, wheat, rice, cotton, and oats exhibit suboptimal growth when exposed to excessive heat, surpassing their temperature tolerance thresholds. Furthermore, the impacts of climate change extend beyond heat stress. Diminishing water availability, both from surface sources and groundwater reserves, will exacerbate crop stress. Additionally, the proliferation of pests and invasive weed species, coupled with an increased risk of wildfires, will further compound the challenges faced by agricultural systems worldwide. These forces driving a reduction in agricultural supply even as demand is projected to increase can drive up prices of these essential food commodities, directly impacting food inflation.

Beyond crops, climate change can impact other sectors, including fisheries and forestry. Rising ocean temperatures and acidification are disrupting marine ecosystems and fish populations. Some fish species are migrating to cooler waters, impacting commercial fisheries and local economies that depend on them. This can reduce catch volumes, leading to potential shortages and higher prices for seafood products, both locally and globally.

Beyond crops, climate change can impact other sectors, including fisheries and forestry. Rising ocean temperatures and acidification are disrupting marine ecosystems and fish populations. Some fish species are migrating to cooler waters, impacting commercial fisheries and local economies that depend on them. This can reduce catch volumes, leading to potential shortages and higher prices for seafood products, both locally and globally.

In addition, increased frequency and intensity of wildfires and droughts are threatening forests globally. Projections indicate that climate change will exacerbate the extent, intensity, and frequency of wildfires, while simultaneously contributing to an upsurge in the severity of insect outbreaks. The combination of warmer spring and summer temperatures, coupled with diminishing water availability, creates ideal conditions for the desiccation of woody materials in forests, heightening the risk of wildfires, which can increase price for lumber and other wood products, which may also impact other sectors through an increase in construction costs.

As extreme weather events and temperature shocks intensify, there can be escalating demand for energy, for example for air-conditioning, even as energy supply can be impacted by reducing the operational efficiency of the energy production infrastructure. For example, fluctuations in precipitation patterns, evaporation rates, runoff volumes, and timing can adversely affect hydropower generation. Similarly, reduced streamflow and rising water temperatures can hinder the cooling processes essential for thermoelectric power plants. This dual effect of heightened energy demand coupled with constrained supply capabilities could result in elevated energy prices and exacerbate inflationary pressures by affecting a wide range of goods and services. Even where energy prices are regulated or set through long term contracts, power shortages can translate into production shortfalls that contribute to higher prices. On the other hand, as costs of renewables such as solar continue to fall and their installation rises – recent estimates indicate that power generation from solar has consistently exceeded forecasts - energy prices could stabilize and even decrease.

Yet another channel is through international trade flows. Maritime transport is particularly exposed to climate-related risks. Rising sea levels directly jeopardize port operations, while shifts in precipitation patterns and severe droughts can disrupt trade flows, resulting in supply chain bottlenecks and fueling inflationary pressures worldwide. For instance, a recent drought in the Panama Canal, caused by below-normal rainfall linked to the El Niño climate phenomenon has slowed cargo traffic in the canal for most of the past year. With water levels in the canal dropping significantly, numerous ships have been forced to take longer alternative routes. This rerouting has exacerbated delays at other ports and increased the demand for trucking and rail services to transport goods, rising costs and greenhouse gas emissions.

In the short run, national policies in response to the impacts of climate change could also add to inflationary pressures. Export restrictions in food producing nations are known to escalate global prices during shortages. Some of the measures taken to internalize harmful externalities and accelerate the energy transition, such as carbon taxes, could also exert an upward pressure on prices even as they motivate changes such as greater end-use efficiencies, and a more rapid adoption of renewables that would lead to stabilizing prices in the medium- to longer- term.

Impacts of climate change on inflation dynamics

While still a relatively new area of study, the literature exploring the potential inflationary impacts stemming from climate change is gradually expanding. Several single-country studies and cross-country analyses indicate that temperatures shocks and changing climate patterns have contributed significantly to recent price developments, particularly food prices, with effects that are stronger and more persistent in developing countries. For instance, during the first half of 2024, countries across East Asia and the Pacific have been grappling with heatwaves, leading to record-breaking temperatures, crop losses, and fish die-offs. Severe heatwaves and drought devastated coffee, vegetables, and rice crops in many countries, including Lao PDR, Vietnam, and Philippines, adding pressure on prices.

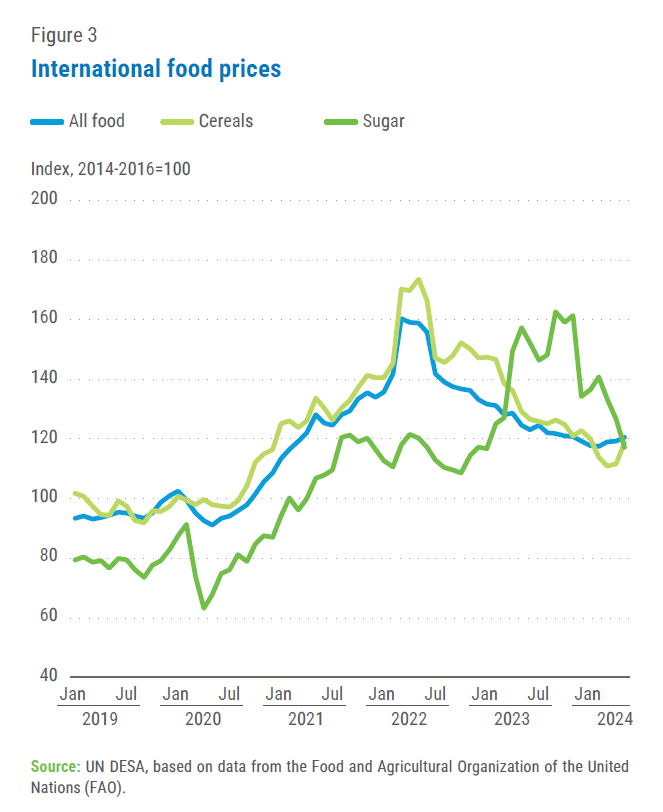

In addition, climate-related shocks and extreme weather events in major exporters countries of staple crops may drive up the international prices of food commodities. In May 2024, according to the FAO, global export prices for all major cereal crops increased (figure 3), with wheat prices seeing the steepest increase on the back of growing concerns about unfavorable crop conditions for the upcoming 2024 harvests, potentially constraining yields in several key producing regions of major exporting countries. Maize export prices also climbed in recent months, reflecting production worries in Argentina and Brazil owing to crop damages and unfavorable weather.

In addition, climate-related shocks and extreme weather events in major exporters countries of staple crops may drive up the international prices of food commodities. In May 2024, according to the FAO, global export prices for all major cereal crops increased (figure 3), with wheat prices seeing the steepest increase on the back of growing concerns about unfavorable crop conditions for the upcoming 2024 harvests, potentially constraining yields in several key producing regions of major exporting countries. Maize export prices also climbed in recent months, reflecting production worries in Argentina and Brazil owing to crop damages and unfavorable weather.

The impact of climate shocks on inflation varies based on the shock type, intensity, country income level, and monetary policy regime. Recent analyses reveal that severe droughts tend to have the highest positive impact on inflation, particularly food inflation, compared to other climatic shocks such as floods and storms. Additionally, rising temperatures have a far more persistent inflationary effect in low-income countries compared to higher-income economies. There are several factors contribute to climate change’s greater impact on food and headline inflation in low-income countries. For example, agriculture accounts for a larger share of their GDP, food comprises a substantially larger portion of their consumption baskets, and they tend to be more trade-insulated, relying heavily on domestic production.

While extreme weather events and rising temperatures undoubtedly disrupt agricultural supply, leading to upward pressure on food prices, their impact on headline inflation is more uncertain. This uncertainty can be attributed to other factors that can come into play. For instance, the presence of reserve foods stocks could mitigate some of the pressure from a supply shock; a period of slowing economic growth or deteriorating income expectations could constrain demand, thus limiting the impact of the initial negative supply-side shock triggered by climate factors on equilibrium prices.

Notably, intensifying climate change and environmental degradation is likely to become a source of price volatility. Other climate-related events such as El Niño might also contribute to food price volatility in many countries, primarily through global commodity and import prices. Some studies reveal that food prices spikes often followed extreme weather events and also have become more likely as a result of climate patterns.

Monetary policy and Central Bank’s challenges amid climate shocks

Through their effect on inflation, climate-related shocks may affect central banks’ ability to achieve their price stability mandate and other objectives, potentially affecting the equilibrium interest rate and the space available for conventional monetary policy. The increased frequency of such climate-related supply shocks will pose challenges for central banks that target inflation. This may require a rethink of the monetary policy framework, including the level of the inflation target. More nuanced and flexible inflation targeting may allow a central bank to use discretion to mitigate other costs of getting inflation quickly back to the target. Climate change might also impair the transmission of central banks’ monetary policy measures to the economy. Furthermore, both climate change and policies to mitigate its effects can have a direct impact on inflation dynamics. Such shocks could have more lasting impacts, causing persistent upward pressure on prices and wages.

Major central banks are increasingly recognizing the importance of climate change risks in achieving their mandates, leading to important innovations. The European Central Bank (ECB) has outlined a complete set of measures to advance the inclusion of climate change aspects into its policy framework. Recently, The ECB has also decided to expand its work on climate change, identifying core areas that will guide its activities in 2024 and 2025, including the impact and risks of the transition to a green economy, the increasing physical impact of climate change, and the risks stemming from nature loss and degradation. Similarly, the Bank of England and the US Federal Reserve have incorporated climate risks within their internal governance and risk management frameworks. On the supranational level, the Network for Greening the Financial System (NGFS), a group of central banks and supervisors from around the world, has undertaken the task of incorporating climate-related risks into supervision and financial stability monitoring. In 2021, the NGFS, the Bank for International Settlements (BIS), and other international financial organizations established the Central Banks’ and Supervisors’ Climate Training Alliance (CTA) to coordinate the regulation of climate risk management.

However, major challenges remain in connecting climate risk drivers to bank exposures and reliably estimating and incorporating climate risks into regulatory frameworks, with data limitations and the long-term nature of climate change complicating risk estimation. Addressing the impacts of climate change will require greater macroeconomic policy coordination to stabilize prices while enabling socially and ecologically responsible global investments. The escalating threat of climate change and environmental degradation to price stability strengthens the case for greening monetary policy in support of a sustainability transition.

Follow Us