Monthly Briefing on the World Economic Situation and Prospects, No. 71

October 2014

Summary:

- Sharp appreciation of the U.S. dollar

- Western European economy continues to struggle

- Ebola takes severe tolls in West Africa

- Download Full Report

Global issues

Emerging economies have seen moderate recovery in capital inflows, but remain vulnerable to financial shocks

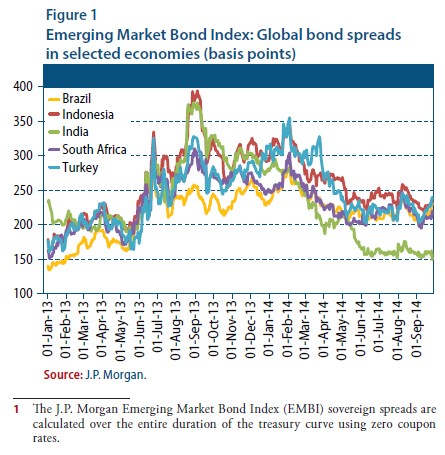

Following the financial market turmoil in mid-2013 and early 2014, emerging economies saw a recovery in capital inflows between February and July amid more stable external financial conditions. Most emerging market currencies have strengthened against the euro and the yen since the beginning of the year, a major exception being the Russian ruble. These currencies also held up well against the dollar until July, but lost some ground over the past two months as investors worldwide flocked to U.S. assets. Sovereign bond spreads for most emerging economies have fallen considerably, including in countries that were seen as particularly vulnerable to a tightening of U.S. monetary policy. In Brazil, India, Indonesia, South Africa and Turkey, which were among the hardest hit by last year's financial turmoil, sovereign bond spreads have declined markedly over the past year (see figure 1).1 In Brazil, Indonesia, South Africa and Turkey, the current spreads are only slightly higher than they were in May 2013, before the United States Federal Reserve Bank (Fed) hinted at tapering its asset purchasing programme; in India they are well below that level. The major stock market indices have also recovered in all five countries, with gains in 2014 ranging from about 5 per cent in Brazil to almost 30 per cent in India.

A combination of global and country-level factors has contributed to the more stable external financial conditions in emerging economies. At the global level, extremely loose monetary conditions have remained in place even as the Fed gradually reduced its monthly asset purchases. Since the beginning of the year, yields on ten-year Government bonds have fallen slightly in the United States of America and, more notably, in other developed countries, such as Germany and Japan. At the same time, policy measures adopted by Governments and central banks in the five countries helped stabilize markets. In particular, the interest-rate hikes implemented between mid-2013 and early 2014 supported capital inflows and national currencies. The monetary policy tightening has, however, also weighed on economic growth, especially in Brazil, South Africa and Turkey (see section on Western Asia). In all three countries, the growth estimates for 2014 have been reduced sharply during the course of the year as domestic demand has remained subdued. The weak growth momentum, along with persisting external imbalances, implies that these countries continue to be vulnerable to an abrupt change in global financial conditions.

The ECB begins latest package of stimulative policies

The European Central Bank (ECB) conducted the first of eight targeted, long-term refinancing operations (TLTROs) in September as part of a package of policies designed to add 1 trillion euro to its balance sheet. A second TLTRO will be initiated in December, with six more during the period 2015 through mid-2016. These programmes continue the ECB practice of letting banks decide on their liquidity needs via various long-term refinancing operations (LTROs) (most famously, the two 3y LTROs at the end of 2011 and beginning of 2012), and consequently the size of the ECB balance sheet, which becomes endogenous. However, there is now an added requirement that these funds must be used to make loans to the private sector. In addition to the TLTRO programme, the ECB announced two additional programmes—one to purchase Asset-Backed Securities and the other a revival of the Covered Bond purchase programme. These differ from LTROs because the ECB would be buying specific amounts of these securities, thereby exogenously determining the size of their balance sheet. In the case of the 3y LTROs, early repayments of these loans shrank the ECB balance sheet from its peak of around 3 trillion euro in mid-2102 to around 2 trillion today. In the first of the TLTROs, European banks borrowed 82.6 billion euros out of a possible 400 billion euros, a much lower amount than analysts had forecast. Demand was likely hampered by the ongoing Asset Quality Review and bank stress tests, with banks attempting to put the best light on their balance sheets. But the results of these tests will be reported in October, so that demand is expected to be much higher in December.

Developed economies

The United Sates: the dollar is appreciating

The U.S. dollar has appreciated significantly in recent months, vis-à-vis other major currencies. For example, the dollar has appreciated by about 10 per cent against the euro in the past three months and 9 per cent against the Japanese yen. Measured by a trade-weighted index against a basket of other currencies, the dollar has appreciated by 4 per cent in the last two months to a level very close to the peak of the past 10 years. The strengthening of the dollar reflects a relatively stronger economic situation in the United States than in a number of other economies. Nevertheless, should U.S. exports slow down as they become more expensive, a continued appreciation of the dollar may eventually curb economic growth. According to the latest official data, real gross domestic product (GDP) in the United States expanded at a 4.6 per cent annual pace in the second quarter of 2014, an upward revision from the previously reported 4.2 per cent. This is the strongest quarter since early 2006, although the rate partly reflects a rebound from the -2.1 per cent recorded in the previous quarter. The data indicated 9.5 per cent growth in business fixed investment and 11.1 per cent growth in exports.

Developed Asia: large foreign exchange intervention

in New Zealand

In August 2014, the Reserve Bank of New Zealand (RBNZ) intervened in the foreign-exchange market by injecting 521 million New Zealand dollars, the largest intervention by the RBNZ since July 2007. Towards the end of September, the New Zealand dollar had depreciated more than 9 per cent vis-a-vis the U.S. dollar over a period of less than two months. In many of its communications, the RBNZ had expressed concerns about the appreciation of the New Zealand dollar, which began in 2000.

Since the introduction of a higher consumption tax rate in April 2014, the Japan's headline inflation rate slowed down gradually from 3.7 per cent in May to 3.3 per cent in August, while economic adjustments to the higher tax rate are still ongoing. In August, both export volume and industrial production had not yet recovered from the plummet triggered by the tax hike. Retail sales increased nominally by 1.2 per cent from one year ago, corresponding to a decline of about 2 per cent in real terms. However, the employment level maintained the improvement accumulated over the past few quarters. In addition, the labour force continued to shrink, helping the unemployment rate to decline to 3.5 per cent in August, the lowest rate since 1997.

Western Europe: continued economic struggles

Short-term indicators continue to paint a picture of slowing growth momentum in the region, while the euro area increasingly flirts with deflation. Measures of activity show a somewhat mixed picture for July: the index for activity in the retail trade sector fell sharply after some months of modest improvement; the construction sector continued to languish; industrial production increased, but only after several months of decline. All in all, the evidence continues to point to a stagnation of activity, with measures of on a declining trend for several months. The European Commission's Economic Sentiment Indicator dipped below its long-term average in September and has been drifting down since the peak in May. The Markit Eurozone PMI Composite Output Index fell to a nine-month low in September. Both readings are consistent with continuing weak growth. This poor profile has led to stagnation in labour markets. Unemployment in the euro area remained stuck at 11.5 per cent in August for the third consecutive month, corresponding to a drop of only 0.5 percentage points since its peak in 2013. Headline inflation continued to decelerate in September to 0.3 per cent year over year. Energy and unprocessed food continued to exert a strong downward influence, but core inflation, which excludes these two categories, dipped as well, from 0.9 per cent in August to 0.7 per cent in September.

The new EU members: business confidence resilient in the face of geopolitical tensions

Despite the precarious international environment created by tensions regarding Ukraine and the downgraded euro area prospects, the overall economic sentiment strengthened in September in the Czech Republic, Hungary and Slovakia. The construction sector reported markedly stronger confidence, indicating an eventual turnaround in the private investment cycle. Those developments reflect the growing importance of domestic demand for economic prospects. However, as fluctuations in the EU-15 business cycle usually affect the new European Union (EU) members with a lag of one or two quarters, the weaker export prospects, if sustained, may feed into lower business expectations.

Inflationary pressures in the region remain subdued despite loose monetary policy, and the Russian ban in August on food imports has diverted food sales to domestic markets, putting further downward pressure on consumer prices. In August, annual inflation was negative in Bulgaria, Estonia, Poland and Slovakia, and near zero in the rest of the region.

The number of tourists from the Russian Federation visiting eastern European countries significantly declined during the 2014 tourism season, in part because of the sharp depreciation of the Russian currency. For some of those countries (Croatia and the Czech Republic, for example), the impact of this smaller number of visitors on tourism revenues may be noticeable.

Economies in transition

CIS: Russian Federation pledges support to sanctioned companies

Amid continuing geopolitical tensions regarding Ukraine, in mid-September the United States and the European Union widened their earlier sanctions against the Russian Federation. Particularly notable are prohibitions against new equity or debt transactions over 30 days for major state-owned banks and oil companies, and a ban on the provision of services for deep water, Arctic offshore and shale oil exploration. In response, the Government of the Russian Federation pledged to support sanctioned banks and oil companies, and is considering the possibility of utilizing the resources of the National Welfare Fund, as well as part of the frozen state pension contributions for 2014 and 2015. The Government has also signaled that no funds will be contributed to the Reserve Fund in 2015, while oil and gas revenues will be diverted into current expenditures. Meanwhile the state of economy remained weak, with zero GDP growth in August, while inflation reached 7.6 per cent. The currency plunged to record lows versus the dollar in September as the new sanctions were announced.

In Ukraine, the contraction of GDP in the second quarter was revised from 4.7 to 4.6 per cent year on year. In August, industrial production shrank by 21.4 per cent year on year and plummeted in the conflict-affected areas by between 60 and 80 per cent year on year. Agricultural prospects are better, with the harvest in September up by over 10 per cent year on year; this should mitigate industrial contraction in the third quarter. The Association Agreement signed by Ukraine with the EU was ratified in September by both the Ukrainian and European parliaments. However, the trade component of the agreement will not be implemented immediately; the country will maintain the current tariffs on EU goods and services until the end of 2015. The Russian Federation warned that the full implementation of the trade component would trigger tariff increases on a large number of Ukrainian products. In Central Asia, construction work commenced in September on the fourth line (line D) of the Central Asia-China pipeline, which will carry natural gas from Turkmenistan through Uzbekistan, Tajikistan and Kyrgyzstan to China. For Tajikistan and Kyrgyzstan, the construction should create employment and investment opportunities.

South-Eastern Europe: strong second quarter growth in FYR Macedonia

The economy of the former Yugoslav Republic of Macedonia posted strong GDP growth in the second quarter, at 4.3 per cent year on year, driven by expanding wholesale and retail trade, financial services and information technology. However, industry, which is the largest sector, stagnated and the construction sector, which was largely responsible for growth in the first quarter, expandedby less than one per cent as some public infrastructure projects were delayed. In Serbia, the industrial decline continued in August, with output contracting by 13.1 per cent year on year, dragged down by mining, electricity and gas supply sectors.

Developing economies

Africa: Ebola takes severe tolls in West Africa

The Ebola outbreak in West Africa continues to take a severe human toll and creates significant problems for the economies directly concerned so far, namely Guinea, Liberia and Sierra Leone. Almost 7200 cases have been officially reported so far, with more than 3300 deaths. The epidemic has disrupted trade and work in the crucial agricultural sector, while putting an unprecedented strain on national resources.

In South Africa, mining contracted by 7.7 per cent in July in the wake of a five-month strike in the platinum sector that ended in June. Similarly, manufacturing shrank by 7.9 per cent because of a four-week strike in July, further compounding the problems created for the sector by tight energy supplies. Kenya rebased its GDP statistics resulting in a 25 per cent increase in the GDP estimates for 2013. The change in the base year from 2001 to 2009 resulted in greater contributions to growth from agriculture, real estate, information and communication technologies, and manufacturing. In contrast to the changes from rebasing in other African countries, the share of agriculture in Kenya's GDP remained relatively constant (see figure 2). In addition, the changes also pushed Kenya over the threshold for a middle-income country, with revised GDP per capita now at $1296 for 2013. The changes also resulted in revised GDP growth rates for a number of years. The most dramatic changes are a harder hit from the crisis in 2008 and a stronger rebound in 2010 and 2011. GDP growth for 2013 was revised up from 4.7 to 5.7 per cent.

In Egypt, the balance of payments registered a surplus for the second year in a row, driven mainly by inflows of aid from Gulf countries. The current-account balance fell by almost two thirds to around 0.9 per cent of GDP. The trade deficit continued to increase, up by 10 per cent, hit by still sluggish tourism revenues, which are down from $9.8 billion in fiscal year 2012/13 to $5.2 billion in 2013/14.

East Asia: high-frequency indicators point to weaker growth in China

After China's GDP growth picked up in the second quarter of 2014, the most recent high-frequency data point to renewed weakness. Imports have declined for two consecutive months, falling by 1.6 per cent year on year in July and 2.4 per cent in August. Growth in industrial output decelerated notably to 6.9 per cent in August, the slowest pace in five years. Other monthly indicators, such as fixed asset investment, retail sales and housing prices, also weakened, albeit less sharply. Exports, by contrast, have remained buoyant, growing by 14.5 per cent in July and 9.4 per cent in August. Faced with slowing domestic demand, the People's Bank of China recently injected about 81 billion dollars into the banking system via loans to the country's five largest banks.

Viet Nam recorded stronger-than-expected growth in the third quarter of 2014, driven by buoyant exports. GDP increased by 6.2 per cent year on year, up from 5.4 per cent in the second quarter and the fastest pace since late 2010. Domestic demand, however, continues to be held back by sluggish credit growth as banks are still saddled with non-performing loans. Consumer price inflation decelerated to 3.6 per cent in September, the slowest rate since October 2009.

South Asia: Sri Lanka's economy continues to grow rapidly

Sri Lanka remains the fastest-growing economy in South Asia. In the second quarter of 2014, GDP expanded by 7.8 per cent year on year, slightly up from 7.6 per cent in the previous three months. All three main economic sectors registered strong expansions, with agriculture growing by 6.5 per cent, industry by 12.2 per cent and services by 5.8 per cent. On the expenditure side, growth continues to be underpinned by strong household consumption, fuelled by rising incomes and remittance inflows, and private and public investment.

Heavy monsoon rainfalls in India and Pakistan led to severe flooding in early September. In Pakistan, the floods are estimated to have affected more than 2 million people, while destroying key infrastructure and seriously damaging cereal and cash crops, including cotton, sugar cane and rice. Weaker agricultural output is expected to weigh on GDP growth, which has been targeted at 5 per cent in the current fiscal year 2014/15. Nepal's Government signed the biggest foreign investment deal in the country's history, agreeing with an Indian infrastructure group on the construction of a dam and tunnel system to exploit hydropower resources in the Himalayas. The project is expected to boost exports to India, reduce local power shortages and strengthen the Government's financial position.

Western Asia: Turkish economy contracts in the second quarter of 2014

The Turkish economy contracted by 0.5 per cent quarter on quarter in the second quarter of 2014. Private and government spending were held back by tighter monetary policy, as the Central Bank of Turkey had increased interest rates earlier this year to avoid further currency depreciations and inflationary pressures. More recently, as the economy continues to slow down, the Central Bank has been under pressure to lower interest rates, despite the fact that inflation remains high, 9.5 per cent in August.

Saudi Arabia's economic growth slowed down to an annual 3.8 percent in the second quarter of 2014, the lowest rate in a year, as a result of a slowdown in the oil sector. The price of Brent crude has sunk by nearly $20 from its June peak to as low as $96 a barrel in recent weeks, its lowest level since mid-2012. This recent sharp drop in oil prices will reduce economic prospects for oil-exporting countries in the region, but has not yet become a serious concern, as many of them enjoy sizeable financial reserves to cope comfortably with lower oil prices. The break-even price is still lower than the current oil price for the majority of oil-exporting countries in the region. The exceptions are Bahrain and Oman, which are already running budget deficits.

Latin America and the Caribbean: unemployment rates remain relatively low, despite subdued growth

The unemployment rate remains relatively low in most of Latin America and the Caribbean, despite the continuing subdued growth and the further deterioration of economic activity in some economies in 2014. For instance, the unemployment rate in Brazil reached a record low of 5.0 per cent last August, 0.3 percentage points lower than August 2013. In Mexico, the unemployment rate has also continued to be low and relatively stable for the past year. In June-August, the seasonally adjusted unemployment rate was 4.9 per cent. In Colombia, the unemployment rate decreased to 9.1 per cent in June-August (moving average), a reduction of 0.4 percentage point year on year. Nevertheless, deteriorating economic conditions in some countries have also lead to lower job creation and moderate rises in unemployment. For instance, the unemployment rate in Argentina reached 7.5 per cent in the second quarter of this year, 0.4 and 1.1 percentage points higher than the previous two quarters, respectively. In Chile, unemployment started to increase by the end of 2013, a trend that has further strengthened in recent months. During June-August (moving average), the unemployment rate increased to 6.7 per cent, 1.0 percentage points higher than the same period last year.

Follow Us